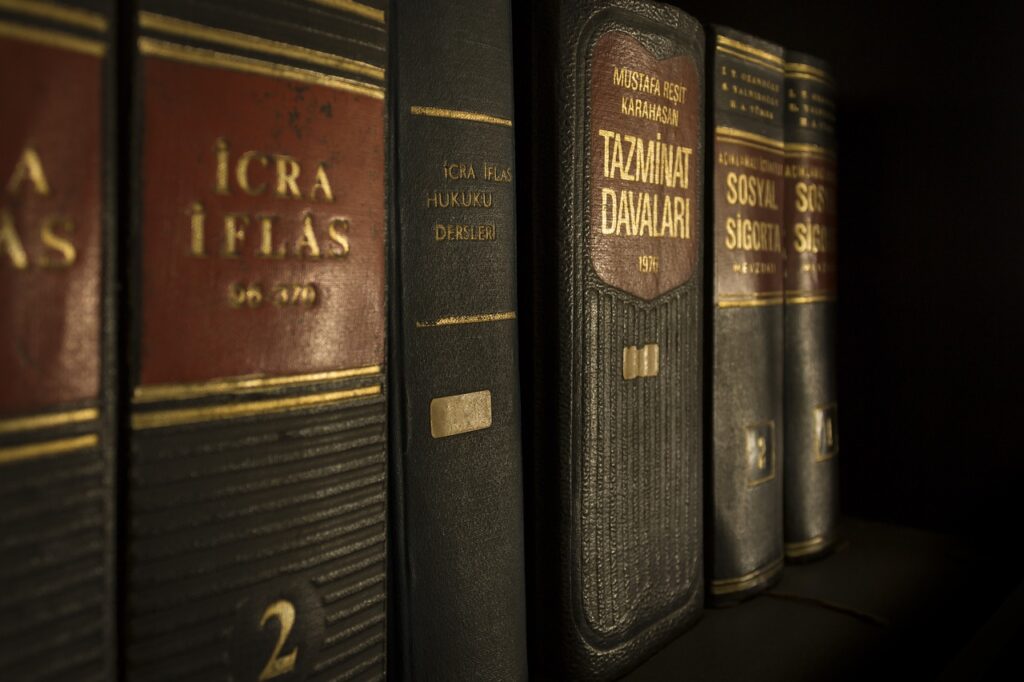

We take appeal as challenge rather than a formality. Mainly, the appeals are made in two forum, viz, the Commissioner (Appeals) of Income Tax / Sales Tax and Federal Excise and the Income Tax Appellate Tribunal (ITAT). Before attending any appeal hearing, we carry out extensive study of the relevant provisions of laws and decided cases. Another proof of our strong grounds of appeal and persuasive arguments is that most of the cases that we attend are finalized very soon. Our tax library is kept up-to-date to provide us the relevant information as and when required. The following services are being provided:

i) Preparation and filing of appeal documents with Commissioner of Income Tax (Appeals)/, Sales Tax and Central Excise.

ii) Preparation and filing of appeal documents with Income Tax Appellate Tribunal.

iii) Research, Preparation of written submissions and attendance before the Commissioner (Appeals) in order to argue/defend appeal.

iv) Research, Preparation of statements of facts and attendance to argue/ defend appeal before the Income/ Sales Tax Appellate Tribunal.

v) Research, Preparation of statements of facts and attendance to argue/ defend reference application before the Income/Sales Tax Appellate Tribunal.